Accelerate and optimise your organisation

We are a financial services consultancy with a focus on operational excellence, transformation, and catastrophic resilience.

Unprecedented times require

proven partners

42stats is an operations, transformation, and catastrophic resilience consultancy specialising in surge events. We most recently designed and managed the largest insurer response to the UK test case, accounting for over 25% of UK BI COVID claims.

Our solutions help financial institutions quickly and efficiently scale their operations, ensure regulatory compliance, and deliver an industry-leading customer experience.

Optimise your organisation for a seamless customer journey

At 42stats, we do more than develop strategies. We leverage our global network of specialist partners to build, deliver, and operationally manage your purpose-built organisation.

Deployed individually or as a complete management solution, our integrated services optimise every touch point of your programme – from communications and complaints handling to data and systems management.

Deliver an industry-leading

surge response

Be there when your customers need it most. 42stats transforms how financial services organisations respond to surge events.

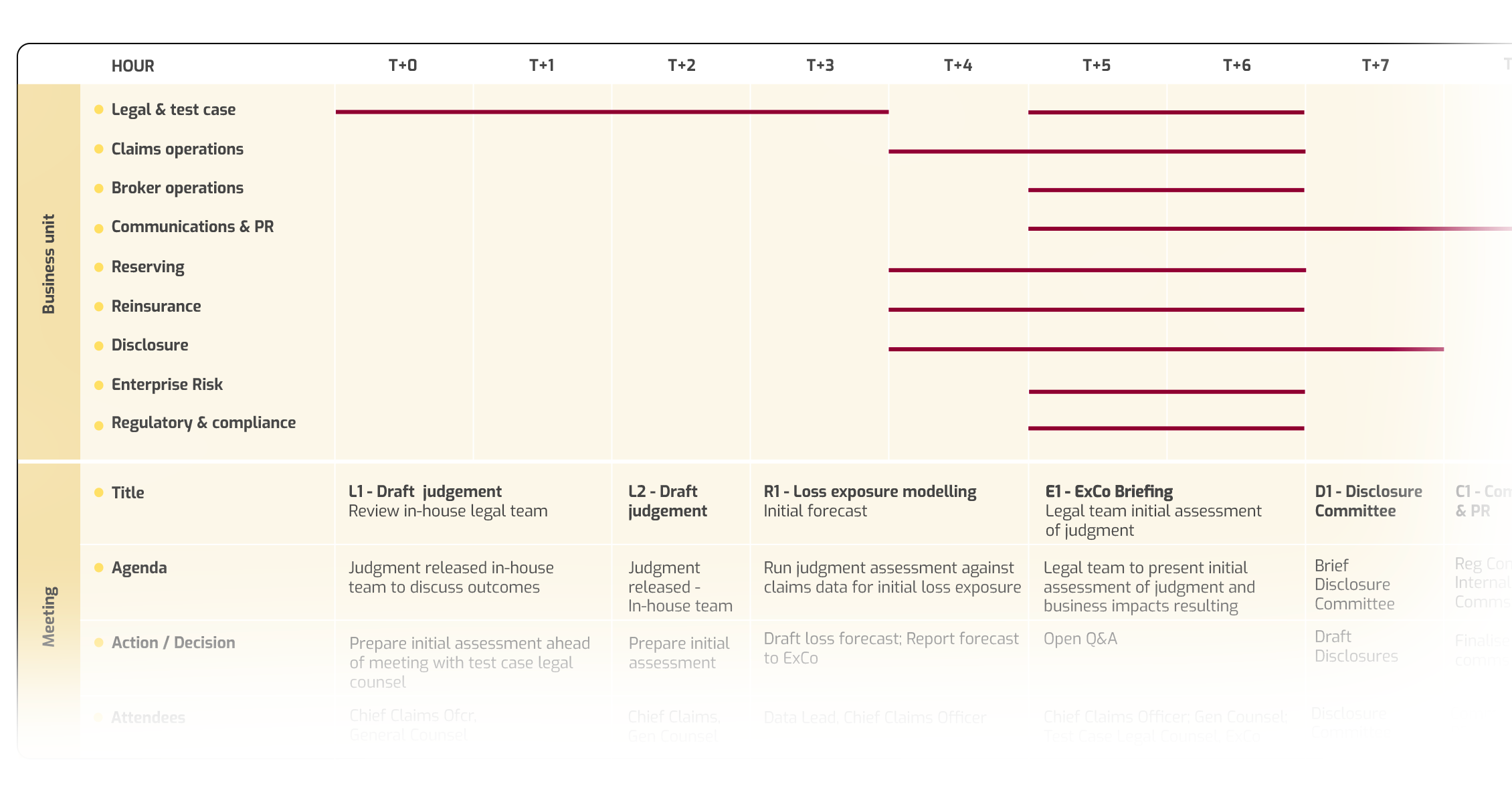

Launch your executive response within hours

Executive Playbooks orchestrate the actions and decisions of your senior leadership team for every hour of the 10 days following the declaration of a catastrophic event.

Catastrophic events require an immediate and coordinated response from executive teams. Insurers must get ahead of the narrative and immediately launch their response to protect market value and minimise executive risk.

Playbooks detail exactly how and when to communicate with customers, brokers, reinsurers, regulators and press in those critical hours and days; and how to launch your response from delivering situation awareness training to mitigating financial and regulatory risk.

Executive Playbook - Sample Day 1 Actions & Decisions (Legal Cat Event Example)

Build operational agility ready for the surge

With Resilience Assessments we enhance your operating model by designing a cross-functional roadmap to quickly scale your claims operations ready for surge events.

Every distinct type of surge carries a unique complexity. Each demands a large-scale coordinated response across internal departments, brokers, vendors, regulators and external service providers. All while facing intense regulatory, political and public scrutiny.

Assessments mitigate your risk. We review every touch point, engage key stakeholders and create the roadmap for scaling your claims processes, resourcing, technologies, data and governance.

Turn catastrophe into customer satisfaction

Stay on top of changing regulation and legislation

Reduce executive risk, control compliance risk and instil critical governance at a time of increased regulatory, political and public scrutiny.

Deliver an industry-leading customer experience

Deliver a seamless experience that maximises customer outcomes, improves retention, reduces complaints and protects brand reputation.

Scale for surge quickly and cost effectively

Rapidly scale teams, processes and technologies to meet surge demand, while managing allocated and unallocated loss adjustment expenses.

Enhance company reputation and market value

Maintain investor confidence and reputation with enhanced Management Information reporting.

“In times of adversity we have the opportunity to shine and reveal our true character. We are proud to have made a difference for thousands of small businesses severely impacted by lockdowns during this pandemic.”

— Team 42stats